Healthcare is becoming more expensive every year, and without health insurance it would be impossible for most people to pay their medical bills. After all, the purpose of health insurance is to protect individuals in the event of extreme and unexpected health care costs. It also ensures that people have access to medical care when they need it. Even in today’s era of the gig economy and the public healthcare marketplace, employer-sponsored health insurance is the most common type of health insurance in the United States.

There are two basic types of health insurance plans. These are:

- Private-funded insurance, most commonly provided by employer-funded plans.

- Taxpayer-funded insurance such as Medicaid, Medicare, and CHIP.

Private-Funded/Employer-Funded Insurance

Employer-sponsored health insurance (also referred to as employee health benefits) is any health insurance plan at least partially paid for by employers/businesses on behalf of their employees. Most private health insurance in the U.S. is employer-sponsored. The money employers contribute to this type of health insurance is typically tax-free, including contributions to health reimbursement arrangements (HRAs).

As a benefit of employment, employees and their dependents, including spouses in most cases, receive this type of health insurance as part of their benefits package. Employer-sponsored health insurance plans currently cover nearly half of the total population in the United States. According to testimony in Congress, almost 99 percent of businesses in the country with 200 or more employees offer some type of health insurance benefits.

A Brief History of Employer-Sponsored Health Insurance

As people continue to debate the pros and cons of the Affordable Care Act and even what the meaning of an “employee” is, it’s important to take a quick look at the history of employer-sponsored healthcare to have an understanding of how that type of insurance came to be, and why companies and hospitals began to value insurance plans in the first place.

Before the 1930s, most people in the country paid their own medical costs. Except for a few organizations, employers had little motivation to provide employee health benefits. As with several other features of modern American life, it turns out that the depression era, World War II, and the attractiveness of increased profits were instrumental in making corporate health plans what they are today.

In the early 1920s, logging and mining companies in the Pacific Northwest began to offer access to company physicians in union-operated or industrial clinics for a monthly fee. These companies realized that a workforce that is healthy enough to work is a more productive and more profitable one.

“As the saying goes, if it makes dollars, it makes sense… With the support of corporate America and the U.S. government, employer-sponsored health insurance became the colossal machine that it is today.”

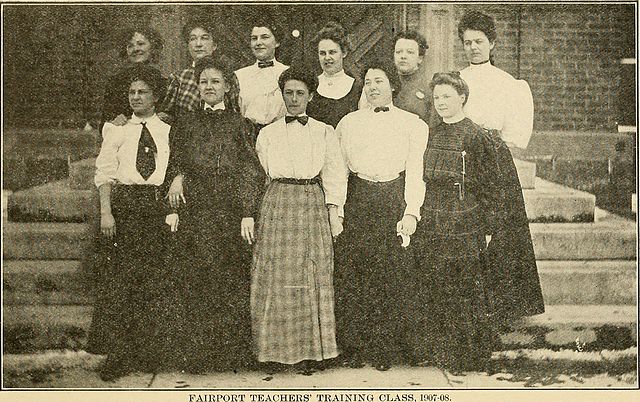

In the meantime, in 1920s Texas, hospitals began offering the ability for teachers to pre-pay for their visits for $6/year (read more about it here). These precursors to modern group health insurance and modern HMOs/hospital networks began to catch on and spread during the Depression era.

By the mid-1940s, the federal government introduced tax breaks for companies that paid into health insurance plans, which came at the same time as strict wartime payroll taxes and wage controls. This law made healthcare expenses non-taxable for both employers and employees at the national, state, and city levels.

This step caused companies to invest heavily in employee healthcare as a way of attracting quality employees, since the wage controls kept them from offering higher wages as a potential benefit. The tax concession also made offering health insurance even more profitable, even for the newer, less physically taxing white-collar economy that was already emerging in the US during the era.

As the saying goes, if it makes dollars, it makes sense- and the rest, as they also say, is history. With the support of corporate America and the government, employer-sponsored health insurance became the colossal machine that it is today.

How Employer-Sponsored Insurance Works

Companies and organizations purchase group health insurance and then offer that insurance to its employees or members. Since employer-funded insurance plans require a group, private individuals cannot receive health coverage through them. Most of these plans require at least 70 percent participation to be valid. Due to the many differences between insurance plans, such as terms and conditions, costs, type of plan, and insurers, no two employer-sponsored insurance plans are the same.

Once an employer chooses a health insurance plan, group members can decline or accept the coverage. Insurance plans come in tiers, so employees have the option of taking a plan with add-ons or basic coverage. The company and its employees split the premiums based on the plan, which, for an extra cost, may extend to an employee’s immediate family and other dependents.

That said, it is vital to understand that the cost of employer-sponsored health insurance is usually lower than that of individual plans. This is because group plans spread the risk across a higher number of individuals.

“How Can I Get Insurance if My Job Doesn’t Offer It?”

If you don’t have access to employer-sponsored health insurance, or if you’re not able to enroll, or even if you think your employer’s plan is too expensive, there are other ways you can get health insurance for you and your family at an affordable rate. Our team is trained to search for every available health insurance option to find the plan that’s best for you. Click below to get more information, or call us at 855-218-3447 to speak with one of our experts directly.

Call Our Insurance Hotline:

Call Our Insurance Hotline: